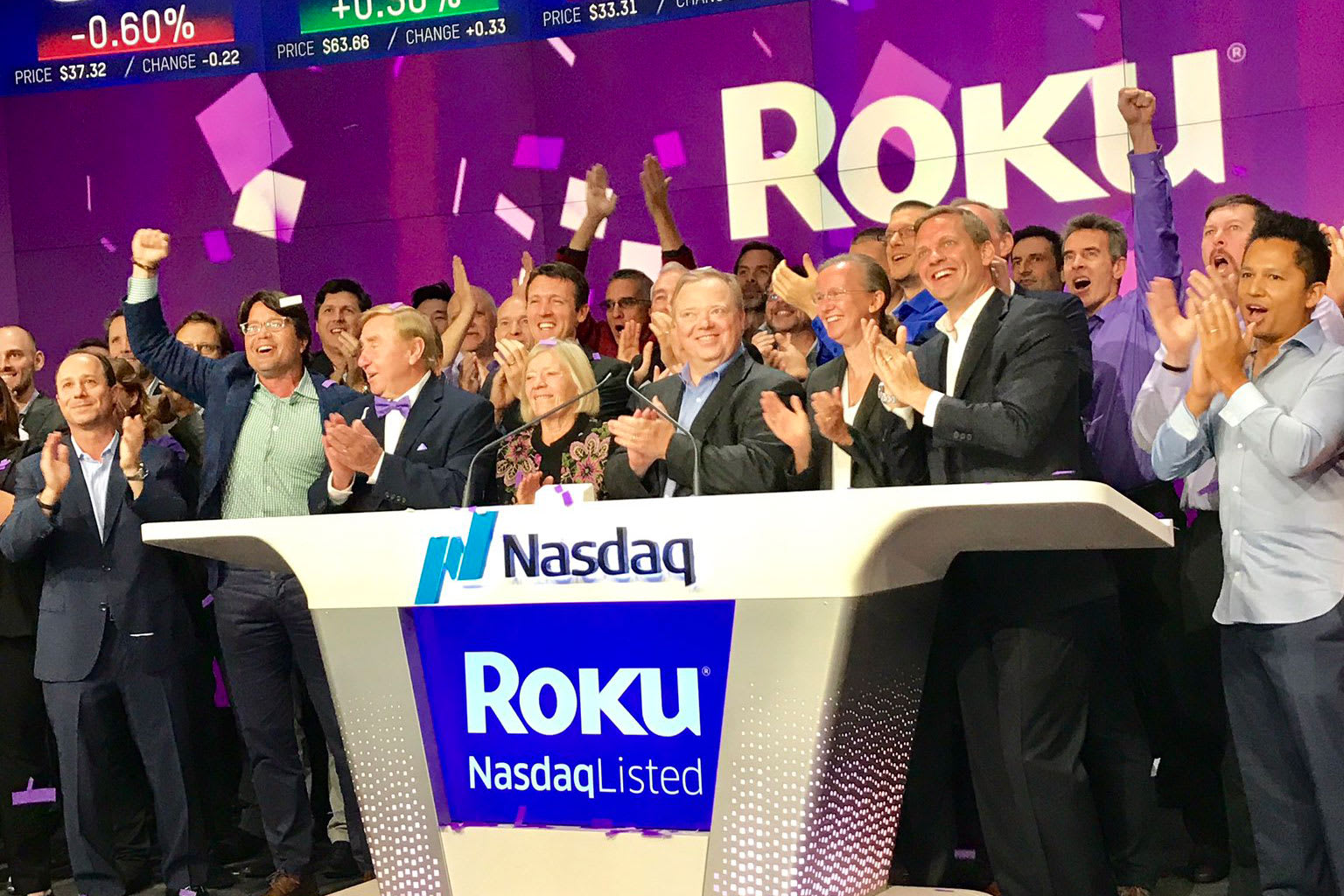

The Roku IPO at the Nasdaq, September 28, 2017.

Source: Nasdaq

Roku has more than quadrupled in value in 2019, making it the best-performing tech stock among U.S. companies with a market cap of at least $5 billion. But it’s been quite a bumpy ride, as investors have puzzled over the streaming company’s future.

On 12 separate days this year, Roku’s stock moved at least 10%, dropping on half those occasions.

The biggest slide came on Sept. 20, when the shares plunged 19% after Jeffrey Wlodarczak, an analyst at Pivotal Research, recommended selling the name with a $60 target (or a roughly 50% decline), citing competition from players who “actually control the dominant data pipe” in U.S. households. Two days earlier, the stock sank 14% after Comcast announced a new streaming box for internet-only subscribers and Facebook introduced Portal TV, a potentially competitive device.

The best day for the bulls was a 28% surge on May 9, after Roku reported better-than-expected first-quarter results. Nearly three months earlier, Roku’s fourth-quarter financials also blew past estimates, lifting the stock 25%. That kind of performance is what analysts at Needham were expecting last December, when the firm named Roku as its top stock pick for 2019.

Roku, which went public in September 2017, sells the market-leading video streaming device and licenses a software-based operating system for smart TVs. It also has a growing advertising business that allows the company to make money from more of the popular shows and movies on its platform. Add it all up and Roku is poised to report 49% revenue growth this year to more than $1.1 billion, accelerating from 45% expansion in 2018.

The challenge for investors is stomaching the volatility of a stock that can get so badly punished with the slightest whisper of competition. And even though Roku’s gross margin has improved over the years, thanks to a bigger emphasis on software, it’s still losing money, a trend that analysts expect to continue through at least next year.

“While there is no question that Roku is the leader in entertainment streaming, it may be time to lock in some profits,” Thomas Hayes, chairman of Great Hill Capital, wrote in an email. “This is one of those cases where the stock might be getting ahead of its underlying business.” Hayes said Great Hill doesn’t have a position in the stock.

As of Friday’s close, Roku was up 355% for the year, giving the company a market cap of $16.5 billion. Among U.S. tech companies worth $5 billion or more, the second-best performer was Shopify, up 195%.

Hayes isn’t alone in the camp of Roku skeptics.

Morgan Stanley analysts downgraded the stock earlier in December and said its 2019 rally reflected the company’s growth prospects and “overall exuberance over all things streaming,” but didn’t take into consideration some key risks. One of those, they say, is that Roku has benefited from its partnership with TV manufacturer TCL. However, active account net additions declined in the third quarter from a year earlier for the first time since early 2017 and is “likely to continue to moderate in the U.S. without new major OEM partners,” the analysts wrote.

Consumers increasingly have more options in terms of how they get their content, ranging from streaming sticks, smart TVs and gaming consoles to connected set-top boxes provided by Comcast or AT&T’s DirectTV.

Then there’s the confusion that Apple has caused in the market about whether the tech giant is a net positive or negative for Roku. When Apple said in September that its Apple TV+ subscription would be free for a year for people who buy its devices, Roku shares fell 10%. But the stock popped 12% on Oct. 15, after Roku said it would be adding the Apple TV app to its platform.

Growing ad business

Roku executives have been talking up the company’s ad business, which is growing swiftly as brands look for ways to reach targeted audiences and Roku expands its channel selection. CEO Anthony Wood was asked by analysts on the company’s third-quarter earnings call if investors should be worried about new entrants taking market share and if that would hurt Roku’s ability to sell ads.

Wood said the onslaught of new services will be a good thing for Roku, underscoring the broader transition to streaming. In other words, Roku will rise with the tide. According to Needham, the increase in the number of over-the-top content providers means diversity away from Netflix, the service that pays Roku the least for a new subscriber.

While ads have been a revenue driver for Roku, eMarketer projects growth in the business to slow from 79% this year to 57% in 2020 and 29% in 2021. Morgan Stanley analysts see a similar pattern on the horizon, noting that the $1 billion mark has been the turning point toward slower growth at Snap, Pandora, Twitter and Facebook.

“There is nothing magical about $1bn in revenue, but ultimately two headwinds to growth emerge,” they wrote. The first is that companies have to go from being experimental platforms to more fundamental parts of the ad market, and the second is that scaling is a challenge, “requiring investment in agency tools and small business self-serve platforms.”

Hisense Roku TV

Roku

In October, Roku announced it was acquiring Dataxu for $150 million, snapping up technology that lets marketers plan and buy video ad campaigns and to get a better sense of how their ads are performing compared with traditional TV.

The reality for Roku is that in all of its businesses, there’s potential pricing pressure from much bigger companies that are more concerned about the eyeballs, at least for now, than they are from making money off streaming. That means they can drop ad rates and offer more attractive revenue splits to content creators, who are shopping around their shows and movies.

As 2019 wraps up, Roku has its own leverage. It’s the top streaming-media player company, with 39% of the U.S. market as of early this year, according to Parks Associates. The direction of the stock will largely depend on whether that market strength translates into bigger business or if competition eats into Roku’s market share and its margins.

Roku “runs the risk of new entrants aiming to encroach on their newfound success,” Hayes said. “There are low barriers to entry as more established media players like Comcast have announced complimentary streaming devices for their internet-only customers.”

Disclosures: Comcast is the owner of NBCUniversal, parent company of CNBC and CNBC.com. NBCUniversal is an investor in Snap.

WATCH: Netflix will lose four million U.S. premium tier subscribers in 2020

Leave a Reply