At around 2:20 a.m. ET, the yield on the benchmark 10-year Treasury note was down at 0.6900% while the yield on the 30-year Treasury bond was fractionally lower at 1.4379%. Yields move inversely to prices.

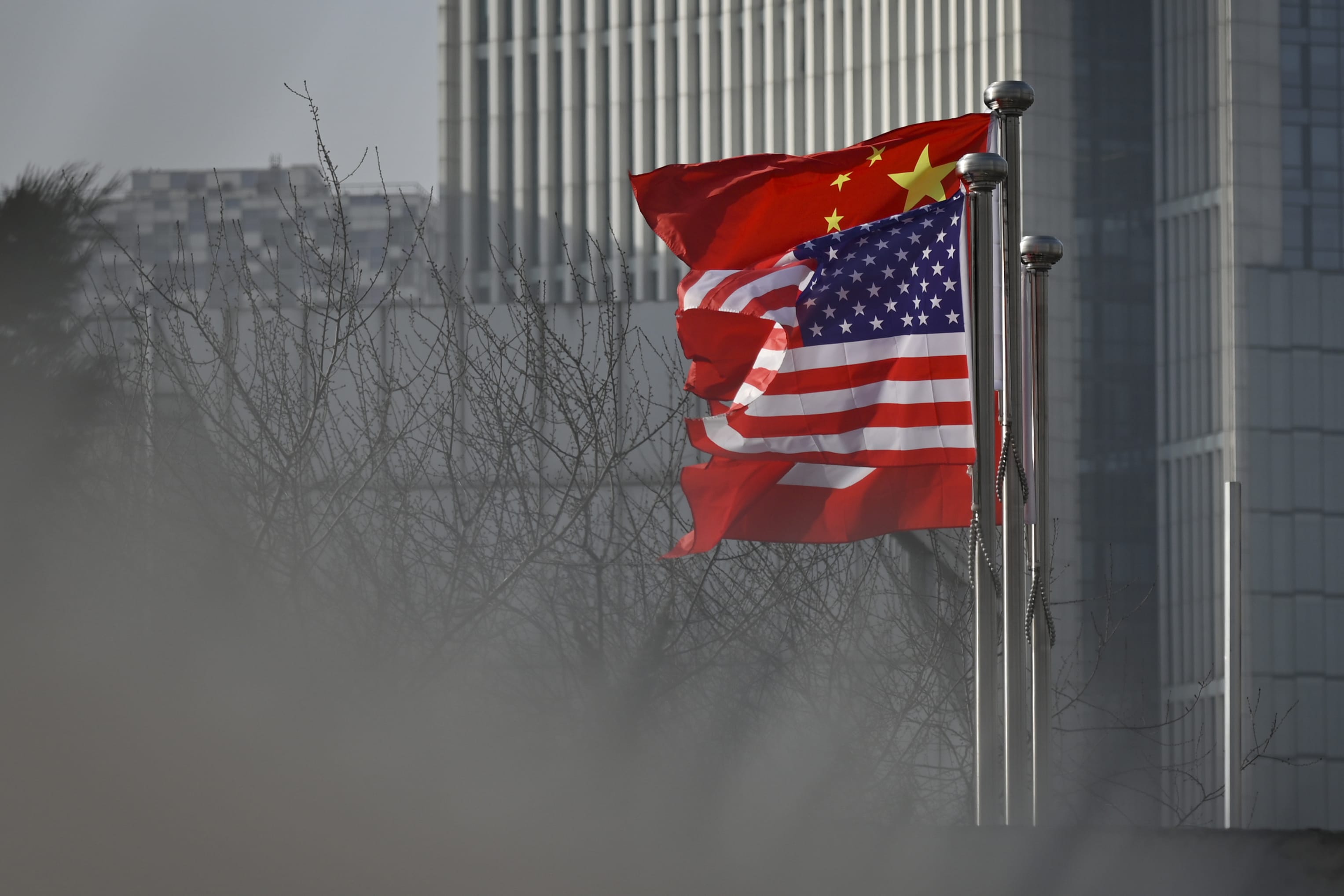

White House economic advisor Larry Kudlow said on Tuesday that President Donald Trump is so “miffed” with China over new Hong Kong security laws and other matters that the landmark “phase one” trade deal signed between the two nations in January is no longer a priority to him.

Bloomberg News reported that the Trump Administration is considering sanctions on Chinese firms and officials over the new laws, which have raised concerns about Beijing’s control over the city in light of pro-democracy protests. President Trump said Tuesday that there will be an announcement on the matter by the end of this week.

The flare-up of tensions between the two economic superpowers has threatened to dent some of the momentum toward risk assets at the start of the week, as investors cheered economic reopening efforts and multiple reports of progress on coronavirus vaccines.

Meanwhile, Senate Majority Leader Mitch McConnell said Congress will “probably” have to pass more legislation to mitigate the economic impact from the coronavirus pandemic. The Kentucky Republican said any new measure to boost the U.S. economy would be narrower in scope than the $3 trillion package House Democrats approved earlier this month.

There is no major economic data scheduled for publication Wednesday.

Auctions will be held Wednesday for $40 billion of 119-day Treasury bills, $25 billion of 273-day bills, $40 billion of 105-day bills, $45 billion of 5-year notes and $20 billion of 2-year FRNs (floating-rate notes).

Leave a Reply